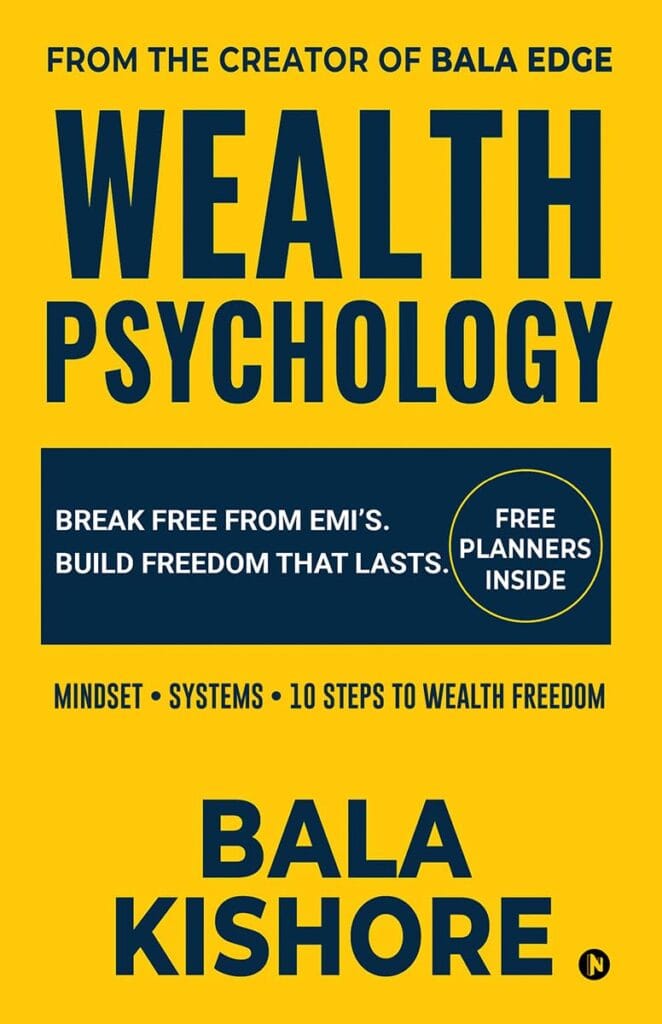

Wealth Psychology

This is the book I wish I had before my first EMI — because real wealth begins in the mind, not the bank.

Table of Contents of the book

Big money is rare. Small consistency is unstoppable.

This chapter shows how tiny savings quietly build massive freedom over time.

Wealth Psychology: Break Free from EMIs. Build Freedom That Lasts.

Note from the Author

The world honestly doesn’t need another heavy book on money.

So why did I write this one?

Because there is a reason most people stay confused about money.

It is explained with fear.

It is taught with jargon.

It is wrapped in complexity.

It is delivered with pressure.

And it quietly makes people feel,

“Maybe money is just not for people like me.”

Wealth Psychology is the book I wish I had before my first EMI — because real wealth begins in the mind, not in the bank.

Something life should have taught me early, but didn’t.

So now, I’m passing it on to you.

— Bala Kishore

Trusted by 100K+ Learners & Followers

What are the readers saying?

Rohit Khandelwal

Finished this book in a single night. What stood out is how real and relatable it is. No complex jargon, no false promises—just practical money clarity. For the first time, I truly understood why my salary never stayed till month-end and how to fix it.

Every middle-class reader must read this once.

Sneha Iyer

I never thought a money book could feel this simple and powerful at the same time. The EMIs, the guilt of spending, the fear of emergencies—it felt like the author was telling my own story. The 1-year reset plan alone is worth the price of this book.

This doesn’t just change how you handle money—it changes how you think about life.

Abhishek Verma

I bought this thinking it would be another generic finance book. I was wrong. This is not about stocks or formulas—it’s about freedom, mindset, and real systems. Within one week, I cancelled two EMIs, started my first SIP, and built an emergency fund plan.

This book doesn’t motivate – it rewires you.

Start anywhere. Reset your money. Every chapter moves you closer to freedom.

Follow us

Need Help?

© Copyright Bala Kishore Enterprises | All Rights Reserved.